Cryptocurrency and the State: Evidence from South Korea

Chloe Ahn

University of Pennsylvania

Nina Obermeier

King’s College London

Chloe Ahn

University of Pennsylvania

Nina Obermeier

King’s College London

12 September 2024

12 September 2024

Cryptocurrencies Go Mainstream

Cryptocurrencies Go Mainstream

92% of adult population under 65 across 15 advanced and emerging economies have heard of cryptocurrency

40% have bought cryptocurrency at some point (YouGov 2023)

Cryptocurrencies Go Mainstream

92% of adult population under 65 across 15 advanced and emerging economies have heard of cryptocurrency

40% have bought cryptocurrency at some point (YouGov 2023)

Background on Cryptocurrencies

Defined as peer-to-peer payment systems that allow online payments to be sent without any financial intermediary (Corbet et al. 2019)

Not central bank digital currencies

First launched in 2009 with Bitcoin; now thousands of cryptocurrencies

Background on Cryptocurrencies

Defined as peer-to-peer payment systems that allow online payments to be sent without any financial intermediary (Corbet et al. 2019)

Not central bank digital currencies

First launched in 2009 with Bitcoin; now thousands of cryptocurrencies

Background on Cryptocurrencies

Defined as peer-to-peer payment systems that allow online payments to be sent without any financial intermediary (Corbet et al. 2019)

Not central bank digital currencies

First launched in 2009 with Bitcoin; now thousands of cryptocurrencies

Cryptocurrency and the State

Cryptocurrencies as potential threat to state functions

Facilitate tax evasion, money laundering, and terrorism financing (Kleiman 2013; Bratspies 2018)

Could undermine monetary policy and economic steering (De Filippi 2014; Claeys et al. 2018)

Importance of state-issued currencies for state control and nation-building (Helleiner 1998; McNamara 2015; Cohen 2018)

Cryptocurrency and the State

Cryptocurrencies as potential threat to state functions

Facilitate tax evasion, money laundering, and terrorism financing (Kleiman 2013; Bratspies 2018)

Could undermine monetary policy and economic steering (De Filippi 2014; Claeys et al. 2018)

Importance of state-issued currencies to state control and nation-building (Helleiner 1998; McNamara 2015; Cohen 2018)

Cryptocurrency and the State

Cryptocurrencies as potential threat to state functions

Facilitate tax evasion, money laundering, and terrorism financing (Kleiman 2013; Bratspies 2018)

Could undermine monetary policy and economic steering (De Filippi 2014; Claeys et al. 2018)

Importance of state-issued currencies to state control and nation-building (Helleiner 1998; McNamara 2015; Cohen 2018)

Cryptocurrency and the State

Cryptocurrencies as potential threat to state functions

Facilitate tax evasion, money laundering, and terrorism financing (Kleiman 2013; Bratspies 2018)

Could undermine monetary policy and economic steering (De Filippi 2014; Claeys et al. 2018)

Importance of state-issued currencies to state control and nation-building (Cohen 1998; Helleiner 1998; McNamara 2015)

Cryptocurrency and the State

Cryptocurrencies as potential threat to state legitimacy

Strong anti-state rhetoric in cryptocurrency communities (Baldwin 2018; Dodd 2018)

Cryptocurrency promoted as solution to government

Cryptocurrency and the State

Cryptocurrencies as potential threat to state legitimacy

Strong anti-state rhetoric in cryptocurrency communities (Baldwin 2018; Dodd 2018)

Cryptocurrency promoted as solution to problems posed by government

Anti-State Rhetoric

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. - Satoshi Nakamoto, 2009

Cryptocurrency and the State

Cryptocurrencies as potential threat to state legitimacy

Strong anti-state rhetoric in cryptocurrency communities (Baldwin 2018; Dodd 2018)

Cryptocurrency promoted as solution to government

Cryptocurrency and the State: The Other Side

Cryptocurrencies have failed to live up to their promises:

Limited utility as payment system (Prasad 2021)

Extreme market volatility

Vulnerable to scams and hacks (Corbet et al. 2019)

High levels of fraud

Cryptocurrency and the State: The Other Side

Cryptocurrencies have failed to live up to their promises:

Limited utility as payment system (Prasad 2021)

Extreme market volatility

Vulnerable to scams and hacks (Corbet et al. 2019)

High levels of fraud

Cryptocurrency and the State: The Other Side

Cryptocurrencies have failed to live up to their promises:

Limited utility as payment system (Prasad 2021)

Extreme market volatility

Vulnerable to scams and hacks (Corbet et al. 2019)

High levels of fraud

Cryptocurrency and the State: The Other Side

Cryptocurrencies have failed to live up to their promises:

Limited utility as payment system (Prasad 2021)

Extreme market volatility

Vulnerable to hacks (Corbet et al. 2019)

High levels of scams and fraud

Cryptocurrency and the State: The Other Side

Cryptocurrencies have failed to live up to their promises:

Limited utility as payment system (Prasad 2021)

Extreme market volatility

Vulnerable to hacks (Corbet et al. 2019)

High levels of scams and fraud

Hypotheses

H1a: Exposure to positive information about cryptocurrencies reduces the public’s trust in government.

H1b: Exposure to positive information about cryptocurrencies reduces the public’s support for government regulation.

Hypotheses

H2a: Exposure to negative information about cryptocurrencies increases the public’s trust in government.

H2b: Exposure to negative information about cryptocurrencies increases the public’s support for government regulation.

Survey Experiment

Fielded to a nationally representative sample of 2,000 South Koreans in December 2022

Manipulated exposure to positive and negative information on cryptocurrencies

Outcomes: trust in governments, support for government regulation of markets, support for government regulation of cryptocurrency

Pre-post design (Clifford et al. 2021)

Survey Experiment

Fielded to a nationally representative sample of 2,000 South Koreans in December 2022

Manipulated exposure to positive and negative information on cryptocurrencies

Outcomes: trust in governments, support for government regulation of markets, support for government regulation of cryptocurrency

Pre-post design (Clifford et al. 2021)

Survey Experiment

Fielded to a nationally representative sample of 2,000 South Koreans in December 2022

Manipulated exposure to positive and negative information on cryptocurrencies

Outcomes: trust in governments, support for government regulation of markets, support for government regulation of cryptocurrency

Pre-post design (Clifford et al. 2021)

Survey Experiment

Fielded to a nationally representative sample of 2,000 South Koreans in December 2022

Manipulated exposure to positive and negative information on cryptocurrencies

Outcomes: trust in governments, support for government regulation of markets, support for government regulation of cryptocurrency

Pre-post design (Clifford et al. 2021)

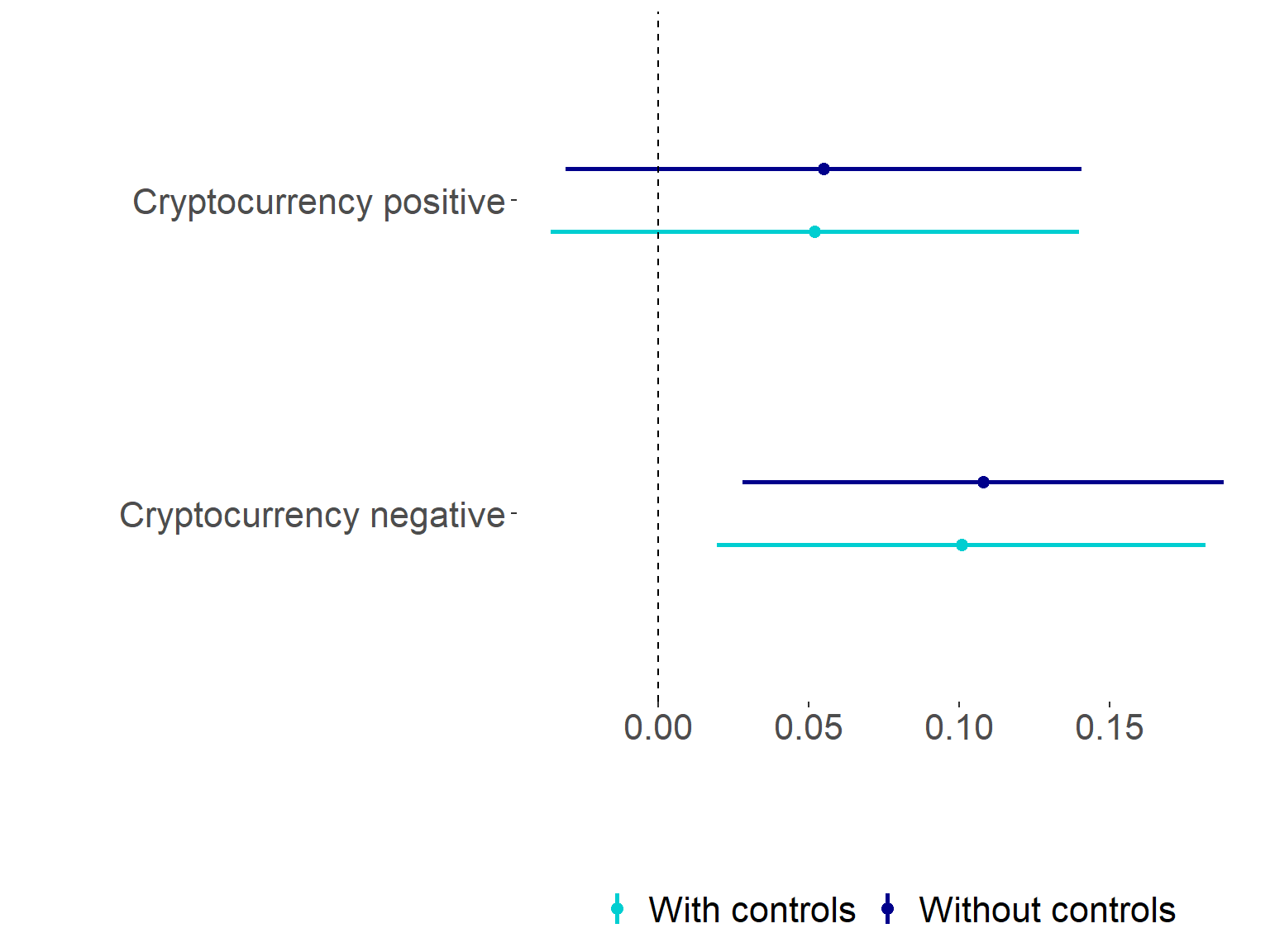

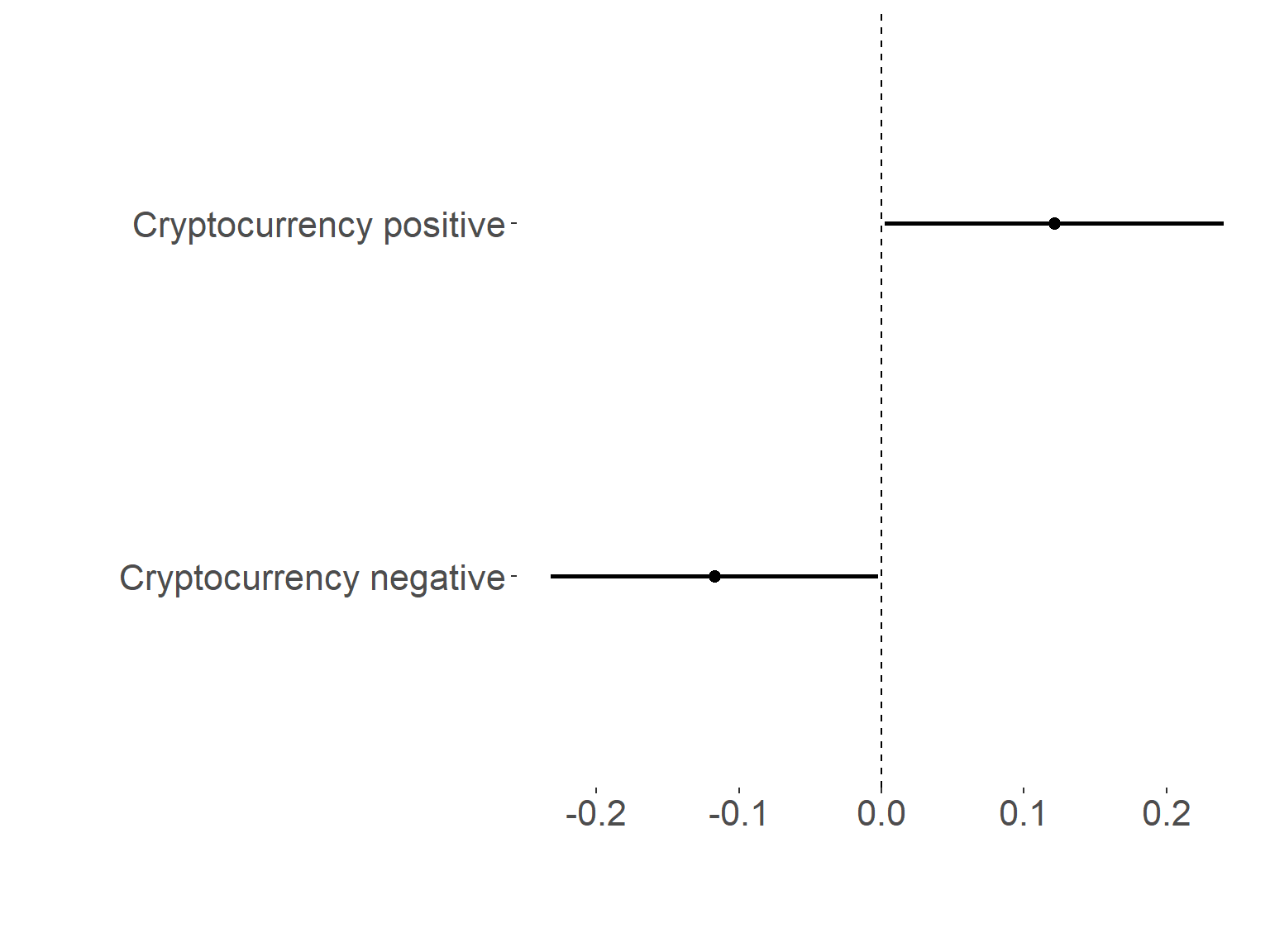

Survey Experiment: Results

Effect of treatments on trust in government

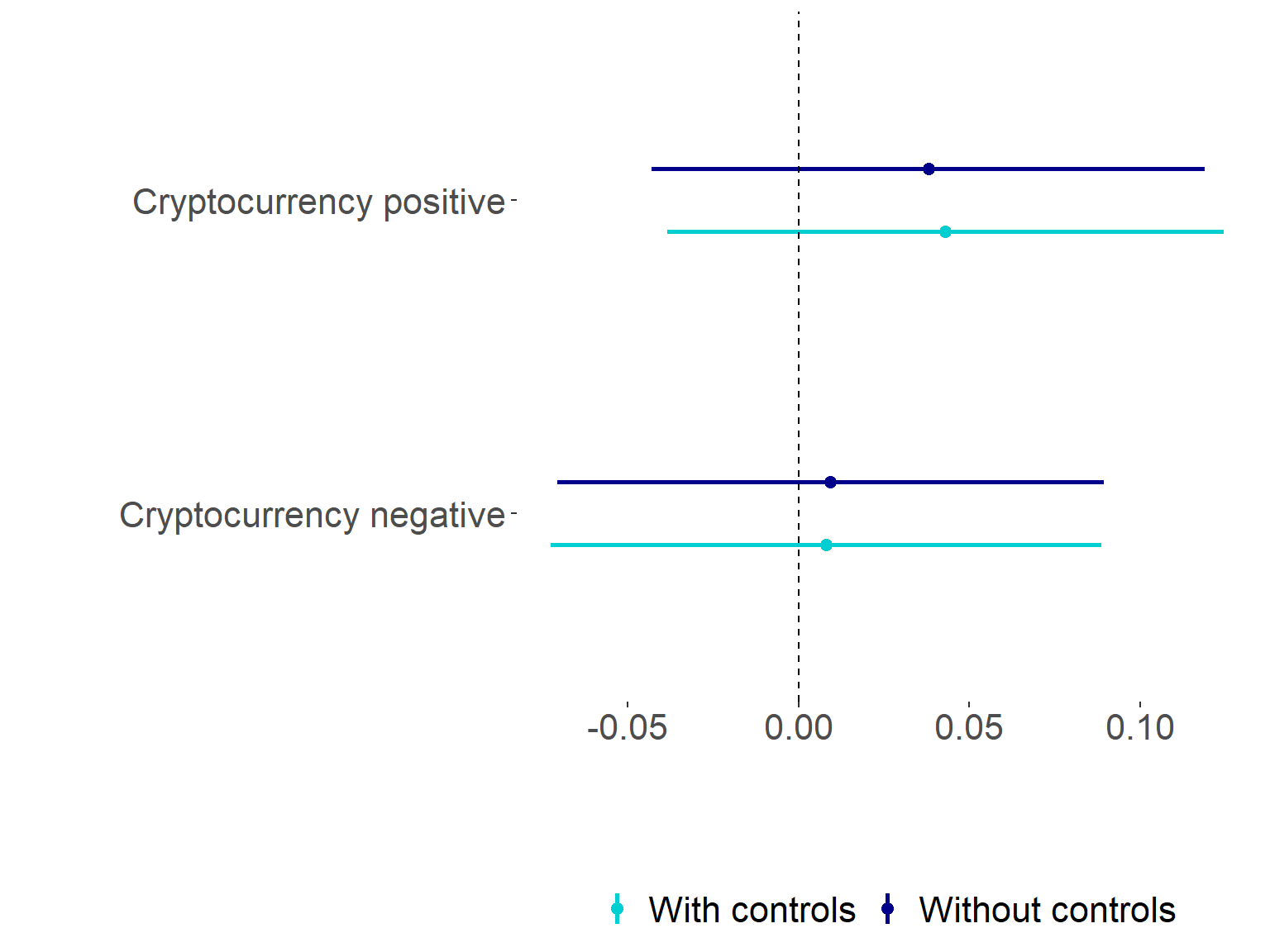

Survey Experiment: Results

Effect of treatments on trust in markets

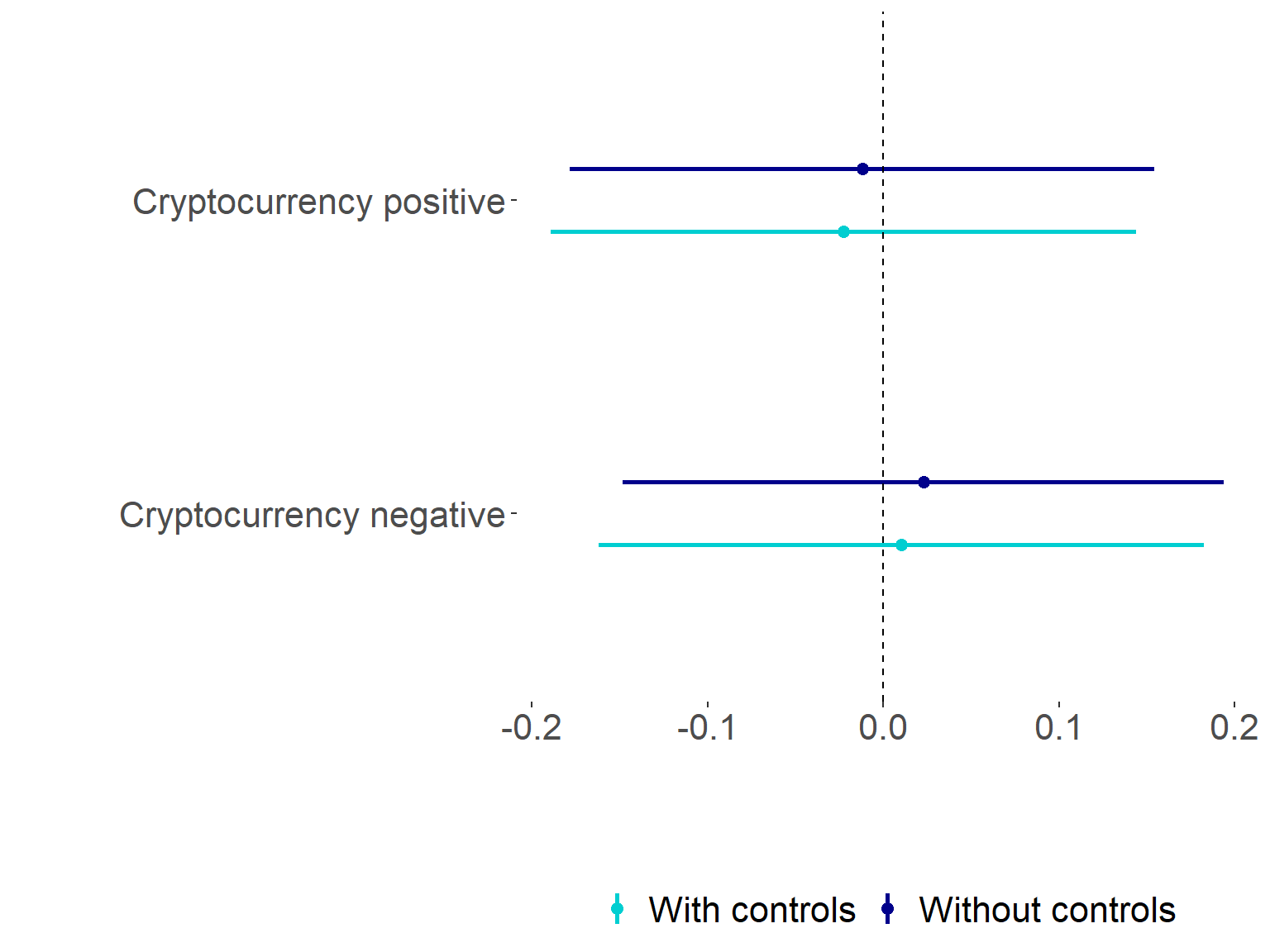

Survey Experiment: Results

Effect of treatments on support for government regulation of cryptocurrency

Survey Experiment: Mechanism

The public associates cryptocurrencies with the absence of government:

“Cryptocurrency trading is too unstable as an investment since it is not officially legalized by the state.”

Survey Experiment: Mechanism

The public associates cryptocurrencies with the absence of government:

“[T]here are no proper regulatory and safety measures in place.”

Survey Experiment: Mechanism

The public associates cryptocurrencies with the absence of government:

“Even stocks, which are somewhat regulated by law, can easily become speculative, but cryptocurrencies lack even the most basic safety measures.”

Survey Experiment: Mechanism

The public associates cryptocurrencies with the absence of government:

“It is a lawless zone without proper legal regulations or guidelines.”

Survey Experiment: Mechanism

The public associates cryptocurrencies with the absence of government:

“While the value of currency is guaranteed by a nation, the value of cryptocurrency is not guaranteed by anyone.”

Conclusion

No evidence that the rise of cryptocurrencies is undermining state legitimacy

Exposure to negative information on cryptocurrencies increases trust in government

Some evidence that this occurs because the public equates cryptocurrencies with lack of government

Conclusion

No evidence that the rise of cryptocurrencies is undermining state legitimacy

Exposure to negative information on cryptocurrencies increases trust in government

Some evidence that this occurs because the public equates cryptocurrencies with lack of government

Conclusion

No evidence that the rise of cryptocurrencies is undermining state legitimacy

Exposure to negative information on cryptocurrencies increases trust in government

Qualitative evidence that this occurs because the public equates cryptocurrencies with lack of government

Implications

Other new technologies may promise to disrupt state-society relations or make government obsolete

Cryptocurrency as benchmark for effect on state legitimacy

Implications

Other new technologies may promise to disrupt state-society relations or make government obsolete

Cryptocurrency as benchmark for effect on state legitimacy

Thank you!

Who Invests in Cryptocurrency?

| Cryptocurrency investment | |

|---|---|

| Age | -0.01 |

| [-0.01; -0.01] | |

| Male | 0.14 |

| [ 0.09; 0.18] | |

| Conservative | 0.01 |

| [-0.01; 0.03] | |

| People Power Party (conservative) | 0.13 |

| [ 0.06; 0.19] | |

| Democratic Party (liberal) | 0.05 |

| [-0.00; 0.10] | |

| Justice Party (liberal) | 0.06 |

| [-0.07; 0.19] | |

| Education | -0.02 |

| [-0.05; 0.00] | |

| Income | 0.01 |

| [-0.01; 0.02] | |

| Employed | 0.09 |

| [ 0.04; 0.13] | |

| Married | 0.01 |

| [-0.04; 0.06] | |

| Num. obs. | 1959 |

| Coefficients with \(p < 0.05\) in bold. | |

Survey Experiment: Positive Information Treatment

Bitcoin Evolving into a More Stable Cryptocurrency: Supported by Several Policies to Overcome Volatility

South Korea is currently in a cryptocurrency frenzy. More and more attempts have been made to overcome the volatility in cryptocurrency in recent years. Various institutional measures are being implemented to prevent large-scale price volatility in cryptocurrency investment. By putting a heavy burden on investors with high risk factors, for example, many efforts are being initiated to prevent the sudden withdrawal of customer funds in the exchange.

More efforts are being made to tame the uncertainty of cryptocurrency markets by incentivizing real-name crypto transactions and increasing the monitoring of suspicious transactions. Policy uncertainties have also been reduced as new bank deposit and withdrawal services have recently been introduced to cryptocurrency exchanges.

It should also be noted that Bank of America, the No. 1 bank in the United States, recently classified Bitcoin as a safe haven asset. As the correlation between gold and Bitcoin has increased from 0 to 0.5 since mid-August this year, investors argue that Bitcoin can be viewed as a “relative safe haven” amid global macroeconomic challenges.

[A], who is currently 38 years old, also has high expectations for Bitcoin transactions. “The uncertainty surrounding blockchain and cryptocurrency is being overcome by the convergence of the Metaverse and NFTs,” he said. 28-year-old [B] similarly said: “Based on current technology, I think business based on the Metaverse and cryptocurrency will grow more stably.”

Survey Experiment: Negative Information Treatment

The Unstable Ups and Downs of Bitcoin: The Sudden Surge and Collapse

South Korea is currently in a cryptocurrency frenzy. Crypto volatility is especially severe in South Korea. Despite concerns over a virtual currency investment bubble, more and more people are seeking their fortunes in cryptocurrency. [A], who is currently 38 years old, said “After seeing an acquaintance increase their Bitcoin investment by more than 300% in Bitcoin, I thought it was an investment method that would maximize profits in a short period of time, so I poured all my spare funds into Coin.”

[A]’s dream, which seemed to be in his grasp during the virtual asset boom, soon disappeared like a mirage. This is because Bitcoin’s return has fallen to -93%. “I wanted to make things better for my family after my father lost his job during the 1997 financial crisis,” [A] said. He received a court decision last month to begin personal rehabilitation. [A]’s reported debt is KRW 37 million. Despite the mediation of the court, [A] has to pay 4 million KRW a month for 36 months.

28-year-old [B] also has many concerns about transactions using Bitcoin, a cryptocurrency. Earlier this year, he purchased Bitcoin with 2 million KRW and made profits of five times the original investment. But because the Bitcoin market fluctuates a lot and is very volatile, he began to check his cell phone routinely more than three or four times every hour. He cannot fall asleep without checking the crypto price before going to bed. “Cryptocurrency is much more addictive than stock trading because it can be traded 24 hours a day and there are no upper and lower market limits,” [B] said.

Survey Experiment: Control Condition

The Plant-Crazy Generation: The Rise of the Houseplant Trend

28-year-old [A] says watching watermelon sprouts at home after work is a small pleasure of everyday life. The watermelon sprouts began to sprout after he planted the remaining seeds in the plastic containers that others threw away. Looking at the watermelon stems that grow higher day by day, [A] finds joy in thinking about when the seeds will bear fruit.

Recently, there has been a craze among young people for ‘houseplanting’, ‘plant-mung’ [being meditative near plants], and ‘companion plants’. It breaks with the stereotype that house plants are exclusively for middle-aged people. ‘Houseplanting’ and ‘plant-mung’ are newly coined words that are mainly used among young people. Houseplanting is a combination of ‘plant’ and ‘butler,’ meaning a person who grows a plant, and ‘plant-mung’ means taking a break while looking at plants. ‘Companion plants’ imply that plants are not grown simply for entertainment, but as real life companions.

38-year-old [B], who grows his own fruit and vegetables, said “I recycled plastic containers and used them as a flower pot. The buds are growing day by day. I don’t know how much it will grow, but I hope the fruit will also open.” [B] also said, “After work, taking care of the seeds and recording how big they have grown on camera became my daily routine. I feel comfortable seeing plant sprouts grow almost as large as a baby’s fingernail!”

Survey Experiment: Manipulation Check

Effect of treatments on perceptions of cryptocurrency

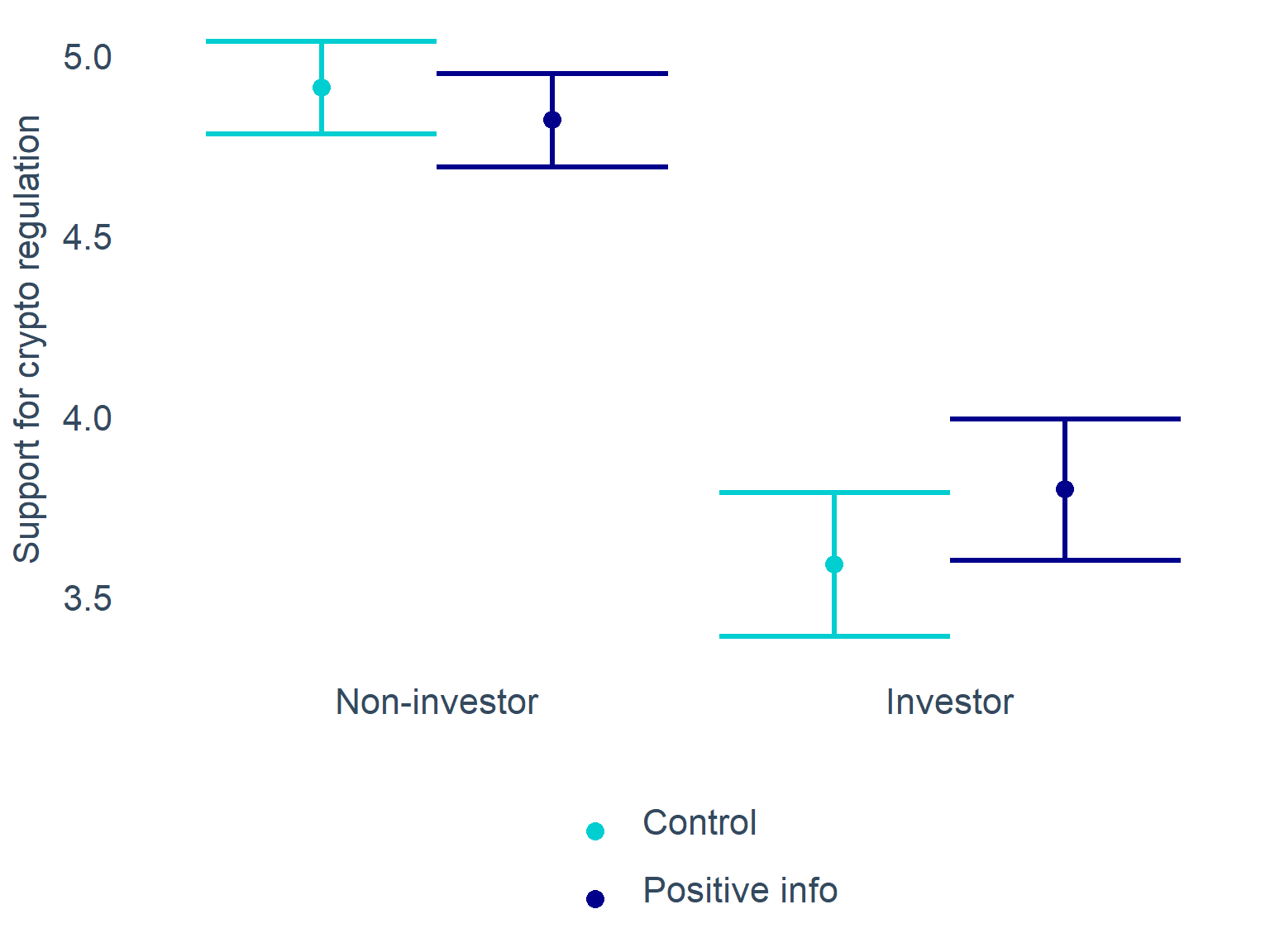

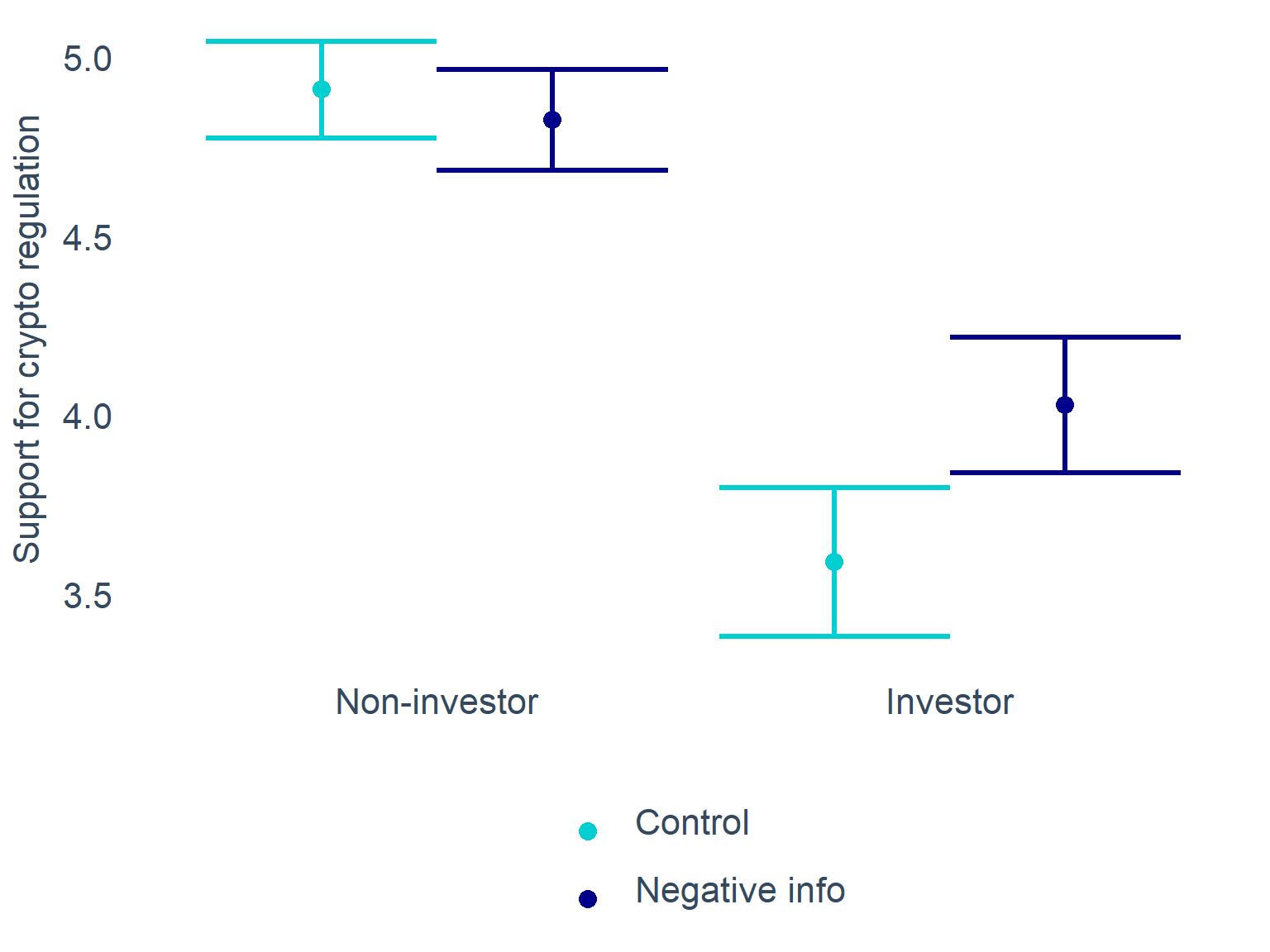

Survey Experiment: Treatment Effects by Cryptocurrency Investment

Exploratory analysis of heterogeneity in treatment effects by cryptocurrency investment

Cryptocurrency investors might be more insensitive to negative information (motivated reasoning) or more sensitive (cryptocurrency losses)

32% of sample has invested in cryptocurrency

65% of investors experienced losses

Survey Experiment: Treatment Effects by Cryptocurrency Investment

Exploratory analysis of heterogeneity in treatment effects by cryptocurrency investment

Cryptocurrency investors might be more insensitive to negative information (motivated reasoning) or more sensitive (cryptocurrency losses)

32% of sample has invested in cryptocurrency

65% of investors experienced losses

Survey Experiment: Treatment Effects by Cryptocurrency Investment

Exploratory analysis of heterogeneity in treatment effects by cryptocurrency investment

Cryptocurrency investors might be more insensitive to negative information (motivated reasoning) or more sensitive (cryptocurrency losses)

32% of sample has invested in cryptocurrency

65% of investors experienced losses

Survey Experiment: Treatment Effects by Cryptocurrency Investment

Exploratory analysis of heterogeneity in treatment effects by cryptocurrency investment

Cryptocurrency investors might be more insensitive to negative information (motivated reasoning) or more sensitive (cryptocurrency losses)

32% of sample has invested in cryptocurrency

65% of investors experienced losses

Survey Experiment: Treatment Effects by Cryptocurrency Investment

Effect of treatments on support for government regulation of cryptocurrency by cryptocurrency investment

Survey Experiment: Treatment Effects by Cryptocurrency Investment

Effect of treatments on support for government regulation of cryptocurrency by cryptocurrency investment